IRS 12508 2021-2026 free printable template

Instructions and Help about IRS 12508

How to edit IRS 12508

How to fill out IRS 12508

Latest updates to IRS 12508

All You Need to Know About IRS 12508

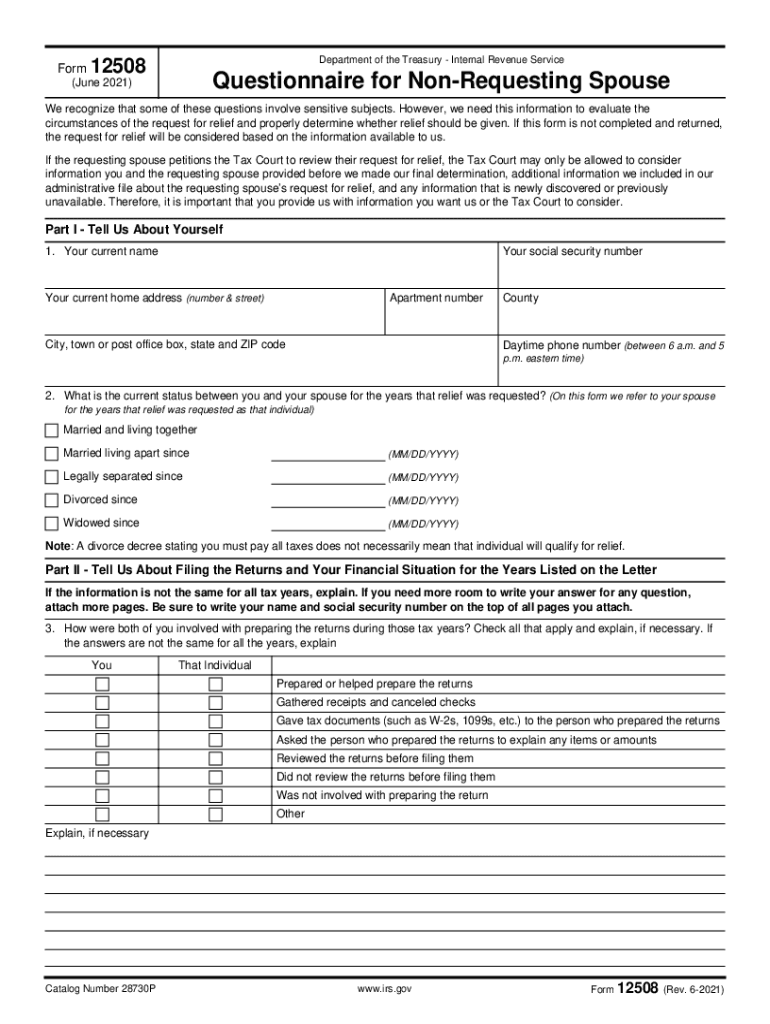

What is IRS 12508?

Who needs the form?

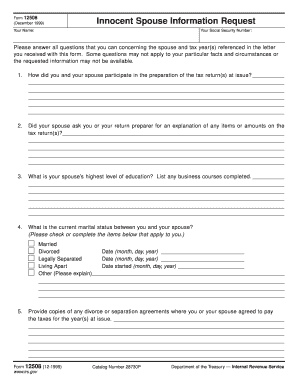

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 12508

What should I do if I need to amend a previously filed IRS 12508?

If you need to correct an error on an already submitted IRS 12508, you should file an amended version of the form. First, identify the specific errors that need correction, and then complete the new version of the form reflecting those changes. Ensure you mark the amended submission clearly in order to avoid processing delays.

How can I verify if my IRS 12508 submission was received by the IRS?

To confirm the receipt of your IRS 12508, you can use the IRS's e-file tracking tool, which provides updates on the status of your submission. Ensure you have details such as the submission date and your identification information handy to facilitate the process.

What common mistakes should I watch out for when filing the IRS 12508?

Common errors when filing the IRS 12508 include incorrect identification numbers and omission of required information. Double-check all fields for accuracy before submitting to ensure compliance and to avoid potential delays or rejections from the IRS.

Are there specific requirements for filing the IRS 12508 for foreign payees?

When filing the IRS 12508 for non-resident or foreign payees, additional documentation may be required to comply with IRS regulations. It's important to verify the specific residency and income guidelines applicable to the payee to ensure proper reporting and compliance.

What options do I have if my IRS 12508 filing is rejected when e-filing?

If your e-filed IRS 12508 is rejected, check the accompanying error codes provided by the software or IRS portal. You typically can correct the identified issues and re-submit the form through the same e-filing platform, ensuring all corrections are made before re-submission.