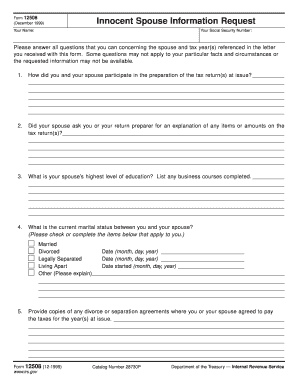

IRS 12508 2021-2025 free printable template

Show details

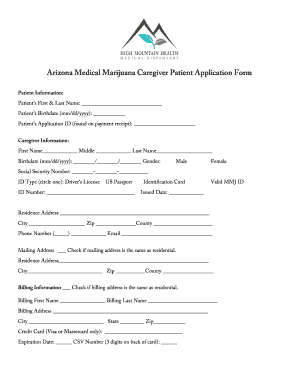

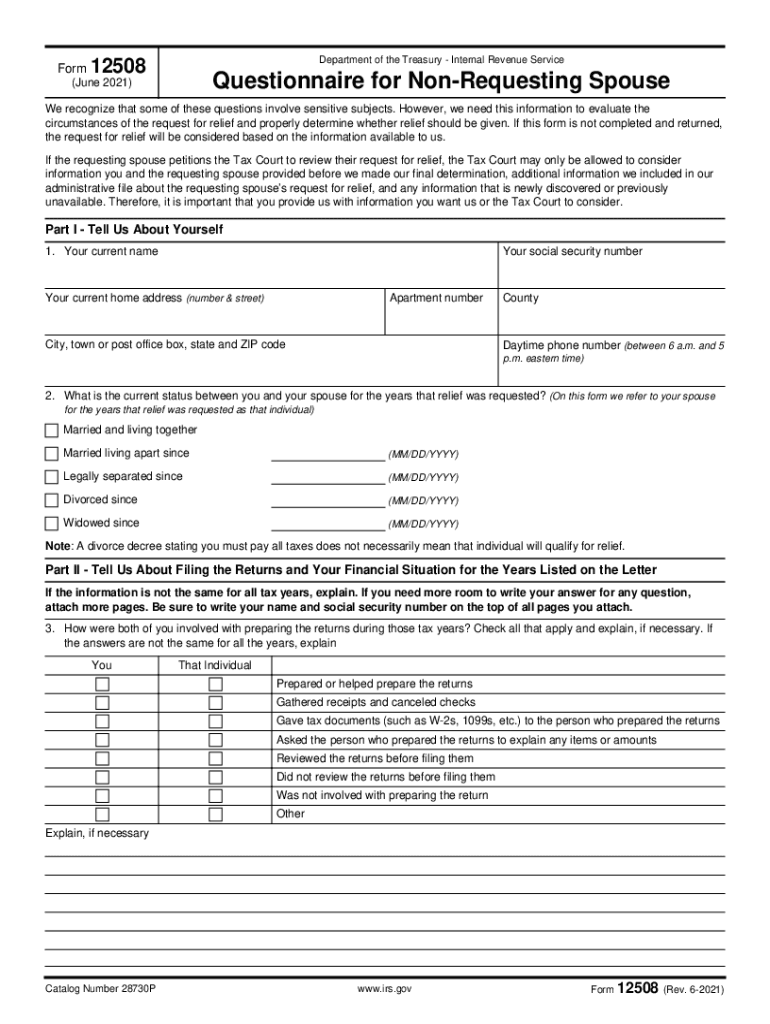

If the answers are not the same for all the years explain You That Individual Prepared or helped prepare the returns Gathered receipts and canceled checks Gave tax documents such as W-2s 1099s etc. to the person who prepared the returns Asked the person who prepared the returns to explain any items or amounts Reviewed the returns before filing them Did not review the returns before filing them Was not involved with preparing the return Other Explain if necessary Catalog Number 28730P...

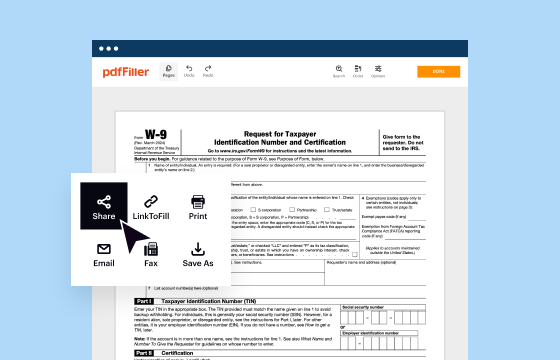

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 12508

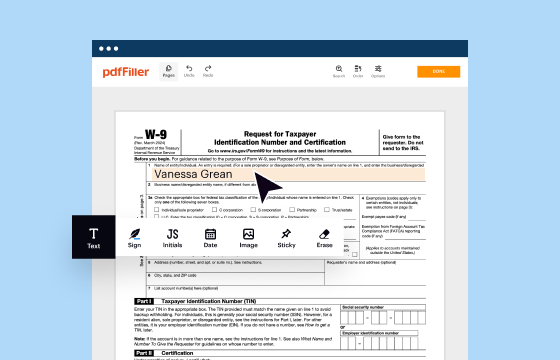

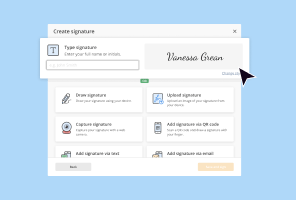

Guidelines for Editing IRS Form 12508

How to Complete IRS Form 12508

Understanding and Utilizing IRS Form 12508

IRS Form 12508 plays a crucial role in the realm of tax compliance, specifically for individuals and businesses navigating certain transactions and reporting obligations. This form aids the IRS in tracking particular tax liabilities and ensuring transparency in financial dealings. Whether you’re an individual taxpayer or part of a corporate entity, understanding how to effectively use and comprehend IRS 12508 is essential for maintaining compliance and avoiding potential pitfalls.

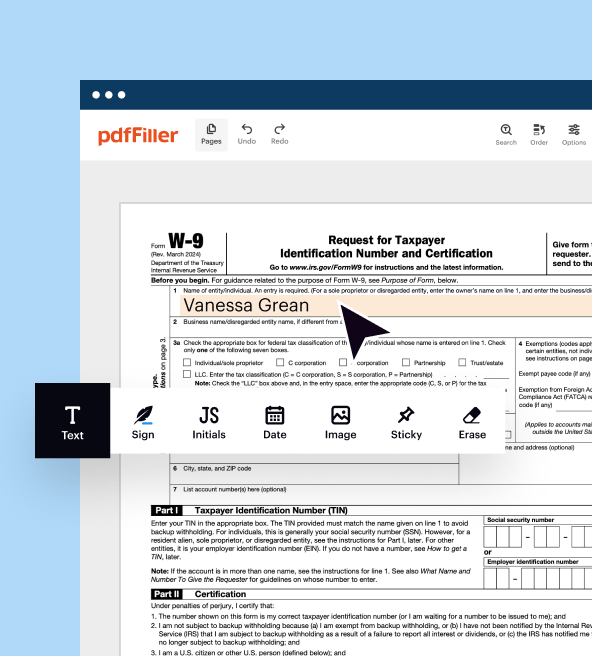

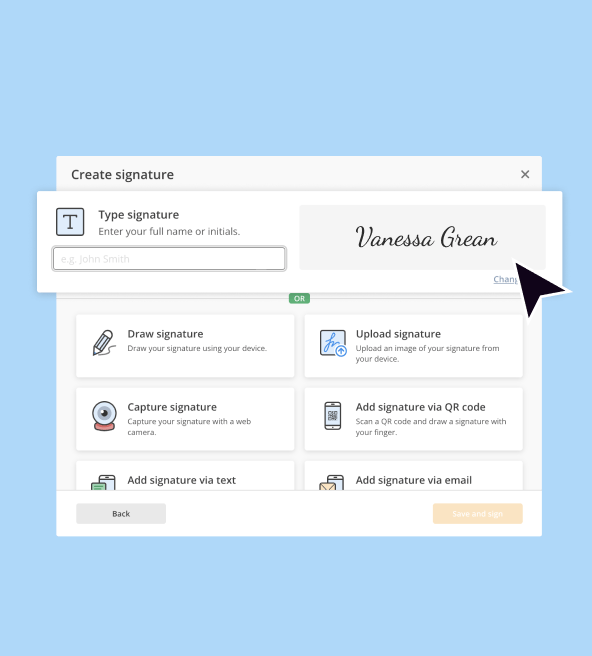

Guidelines for Editing IRS Form 12508

Editing IRS Form 12508 requires careful attention to detail to ensure accuracy. Follow these steps:

01

Review the form for any pre-filled information if it's automatically generated.

02

Check that all sections relevant to your filing status or transaction type are filled correctly.

03

Make sure to update any personal identification numbers, such as Social Security or Employer Identification Numbers, if changes occurred.

04

Examine each data entry to ensure it aligns with your financial documentation.

05

Double-check your calculations to verify the accuracy of reported figures.

06

Ensure you have signed the form where applicable before submission.

How to Complete IRS Form 12508

Completing IRS Form 12508 involves several straightforward steps:

01

Gather necessary documentation such as income records, transaction details, and any previous tax forms.

02

Begin by entering your personal information in the designated sections, including your name and address.

03

Proceed to fill out the transaction or reporting sections, making sure to abide by any specific guidelines.

04

Input any exemptions you qualify for, if applicable, supported by necessary documentation.

05

Review the completed form for any errors before considering it for filing.

Show more

Show less

Recent Revisions and Updates to IRS Form 12508

Recent Revisions and Updates to IRS Form 12508

The IRS regularly updates its forms and procedures to keep pace with changing regulations. Recent changes to Form 12508 include:

01

Increased reporting requirements for certain transactions, emphasizing documentation for greater transparency.

02

Adjustments to exemption thresholds that may affect eligibility for many taxpayers.

03

The introduction of new error correction processes to simplify the amendment procedure for taxpayers.

Essential Insights into IRS Form 12508

Defining IRS Form 12508

The Purpose Behind IRS Form 12508

Identifying Who Should File IRS Form 12508

Understanding Exemptions Applicable to IRS Form 12508

Understanding the Filing Deadline for IRS Form 12508

Comparing IRS Form 12508 with Similar Tax Forms

Transactions Typically Covered by Form 12508

Required Copies for IRS Form 12508 Submission

Potential Penalties for Non-compliance with IRS Form 12508

Information Necessary for Filing IRS Form 12508

Accompanying Forms with IRS Form 12508

Where to Submit IRS Form 12508

Essential Insights into IRS Form 12508

Defining IRS Form 12508

IRS Form 12508 is designed to report certain transactions that may affect tax liability. It functions as a disclosure document that provides the IRS with pertinent financial information necessary for accurate tax assessments.

The Purpose Behind IRS Form 12508

The core purpose of IRS Form 12508 is to facilitate the reporting of specific transactions that could influence tax obligations. This ensures that taxpayers meet their tax responsibilities while providing the IRS with the necessary information to maintain compliance in the tax system.

Identifying Who Should File IRS Form 12508

Form 12508 should be completed by individuals and businesses engaged in transactions that meet specific criteria, including:

01

Taxpayers involved in sales or exchanges of property.

02

Entities reporting certain investment income or expenses.

03

Individuals claiming exemptions related to specific transaction types.

Understanding Exemptions Applicable to IRS Form 12508

Exemptions from completing IRS Form 12508 are available under certain conditions. Qualifying circumstances include:

01

Income below specific thresholds set forth by the IRS.

02

Transactions that fall below certain monetary limits, such as below the minimum reporting amount.

03

Organizations operating in designated sectors, such as charities, may be exempt.

For instance, a taxpayer whose gross income is below the threshold set by the IRS for a given tax year might not need to file this form.

Understanding the Filing Deadline for IRS Form 12508

The filing deadline for IRS Form 12508 aligns closely with the annual tax filing deadlines. Generally, it should be submitted by the tax return due date, typically April 15th for individuals. For businesses, the deadline may differ based on the type of entity.

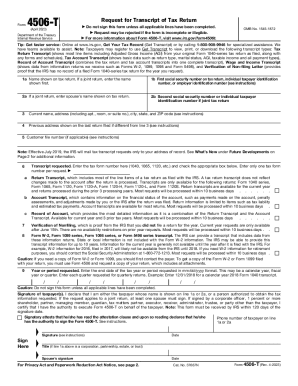

Comparing IRS Form 12508 with Similar Tax Forms

When it comes to managing tax obligations, IRS Form 12508 shares similarities with forms such as Form 8949, which also deals with reporting capital gains and losses. While Form 12508 focuses on specific transactions, Form 8949 is broader in its reporting scope regarding sales of capital assets.

Transactions Typically Covered by Form 12508

IRS Form 12508 generally covers transactions relating to:

01

Sale of real property.

02

Incorporation of an asset into business operations.

03

Transfer of property interests between entities.

Required Copies for IRS Form 12508 Submission

When submitting IRS Form 12508, taxpayers typically are required to send one copy to the IRS. However, it is advisable to retain a copy for your records, along with any supporting documentation.

Potential Penalties for Non-compliance with IRS Form 12508

Failure to file IRS Form 12508 can lead to significant penalties, such as:

01

Monetary fines based on the severity of late submission—up to $250 per day for non-compliant filers.

02

Increased scrutiny from the IRS, which can lead to audits or further investigations.

03

Loss of entitlement to specific exemptions that may impact future tax liabilities.

For example, a taxpayer who neglects to file the form could incur financial penalties of several thousand dollars depending on the length of delay and circumstances.

Information Necessary for Filing IRS Form 12508

To complete IRS Form 12508 accurately, gather the following information:

01

Taxpayer identification details, including name and address.

02

Specific transaction details including dates, amounts, and involved parties.

03

Relevant financial records that support the information reported on the form.

Accompanying Forms with IRS Form 12508

While IRS Form 12508 may be submitted independently, it may require accompanying forms, such as detailed documentation supporting claimed exemptions or previous tax forms pertinent to the current submission.

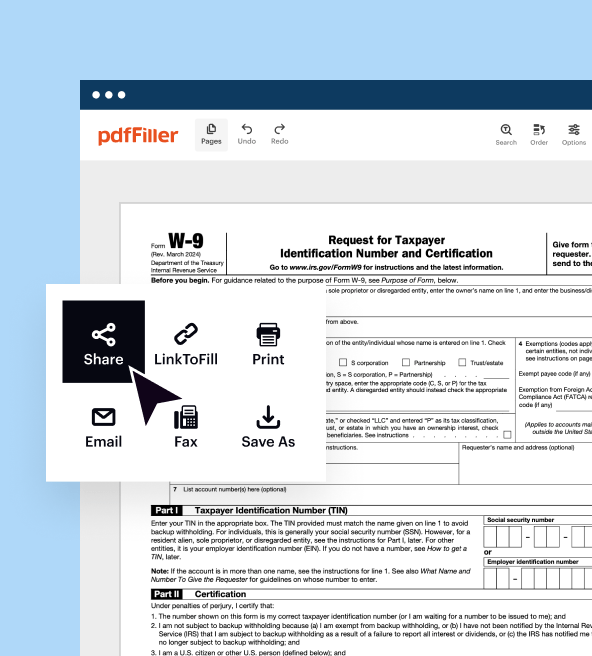

Where to Submit IRS Form 12508

The submission address for IRS Form 12508 depends on the taxpayer’s location and filing status. Typically, forms are sent to the appropriate IRS processing center indicated in the form instructions. Make sure to verify the correct address based on your residence to avoid delays.

In conclusion, IRS Form 12508 plays a critical role in tax compliance for specific transactions. Understanding its purpose, filing requirements, and the implications of non-compliance can significantly benefit taxpayers. For further clarification and assistance with your tax preparation needs, don't hesitate to reach out to a tax professional or utilize online resources that guide you through the process. By taking proactive steps, you can ensure your financial accuracy and compliance.

Show more

Show less

Try Risk Free